Article also available in / Articol disponibil și în limba: Română (Romanian)

DAC6 – New EU tax mandatory disclosure rules with regard to cross-border transactions

article published on 6 February 2019

Executive summary

The EU Directive 2018/822 (also known as ”DAC6”) creates a new tax transparency framework by introducing a new obligation to report cross-border arrangements which fall within certain “hallmarks”.

According to the text of the Directive, the obligation to report a cross-border arrangement may fall on either (i) a qualified intermediary e.g. consultants or (ii) taxpayers themselves, in cases where the intermediary is entitled to legal professional privilege or a qualifying intermediary is absent.

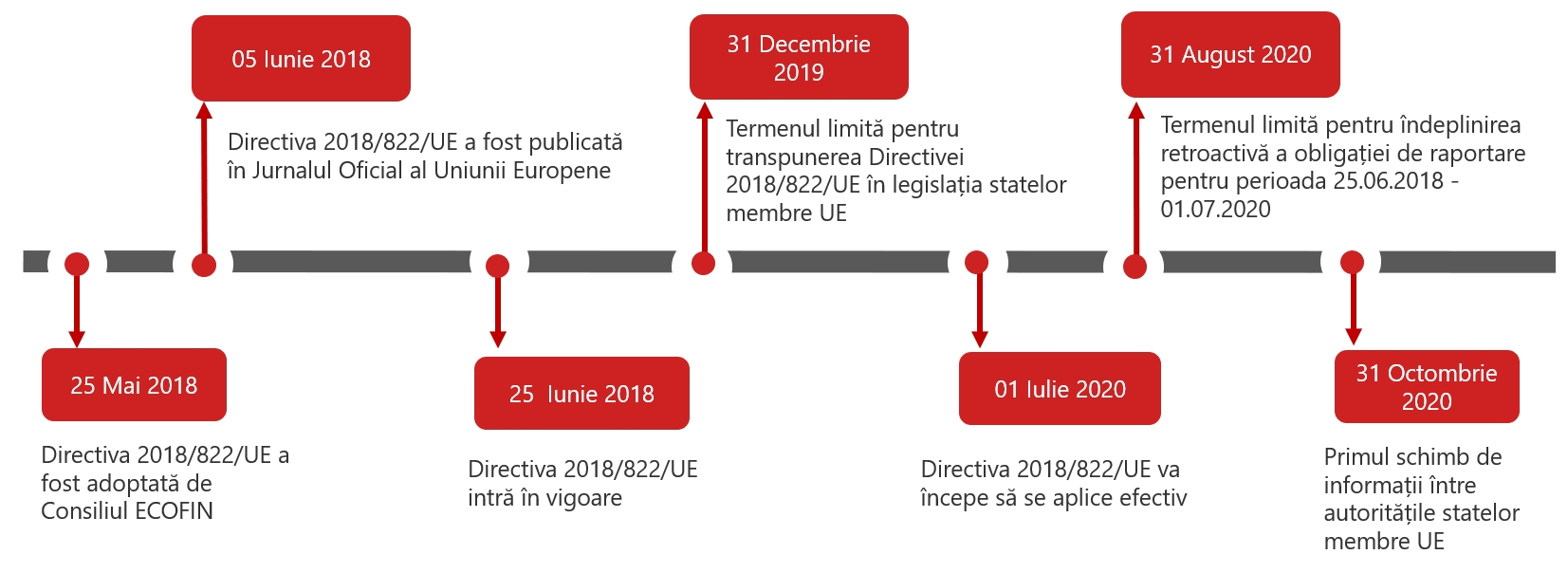

The reporting obligation become fully applicable on July 1, 2020.

See more on our DAC6 reporting services.

However, it is important to note that there will be mandatory to report those reportable arrangements that were designed, marketed or implemented after June 25, 2018.

Background

Although tax authorities in European Union already had available instruments by which they could have cooperated in the fight against profit shifting (i.e. Directive 2011/16/EU on administrative cooperation among Member States’ tax authorities), these instruments haven’t worked as they were expected from the beginning. As a consequence, there were six updates to the original EU Directive 2011/16 from 2011 to 2018.

Moreover, the Action Plan on Base Erosion and Profit Shifting (“BEPS”) approved by the Organization for Economic Cooperation and Development (“OECD”) and endorsed by G20 leaders in September 2013 has highlighted the need to improve existing instruments or to create new instruments to combat profit shifting.

The latest amendment is operated by EU Directive 2018/822 which aims to create an instrument for reporting cross-border arrangements and subsequently for automatic exchange of information between Member States.

What is considered a cross-border arrangement as per DAC6 provisions?

The EU Directive 2018/822 did not provide a clear definition of what needs to be reported, but it lists several features that make a cross-border arrangement reportable.

The most commonly encountered features that a reportable cross-border arrangement should have are:

(i) the acquisition of companies with tax losses carried over from previous years in order to use those tax losses and reduce their own tax liabilities subsequent to the acquisition;

(ii) involvement in the ownership structure of companies from jurisdictions that do not share information about the ownership;

(iii) involvement in the ownership structure of companies whose activity is not supported by adequate staff, equipment, assets and premises;

(iv) the transfer of hard-to-value intangibles;

(v) an intragroup cross-border transfer of functions and/or risks and/or assets, if the projected annual earnings before interest and taxes (EBIT), during the three-year period after the transfer, of the transferor or transferors, are less than 50% of the projected annual EBIT of such transferor or transferors if the transfer had not been made.

In addition to the features that make a cross-border arrangement reportable, it must be demonstrated that the implementation of the tax arrangement leads to tax benefits that would not be due in the absence of it (“benefit test”).

Who should report cross-border transactions as per DAC6?

According to the text of the EU Directive 2018/822, the reporting obligation of a cross-border arrangement may fall on either (i) a qualified intermediary (i.e. tax advisers, lawyers, accountants, auditors or any other person that directly or indirectly designs, markets, organizes or makes available for implementation or manages the implementation of a reportable cross-border arrangement or those who provide aid, assistance or advice in relation to such arrangements), or (ii) taxpayers themselves, in cases where the intermediary is entitled to legal professional privilege or a qualifying intermediary is absent.

A tax advisor, a lawyer, an accountant, an auditor or any other person directly or indirectly involved in designing, marketing, organizing, making available for implementation or manages the implementation of a reportable cross-border arrangement that has one or more of the “hallmarks” set out in the EU Directive 2018/822, has the obligation to report the cross-border arrangement to the tax authorities of their home Member State.

In other words, the reporting obligation rests only with those who have had any directly or by means of other persons, aid, assistance or advice with respect to designing, marketing, organizing, making available for implementation or managing the implementation of a reportable cross-border arrangement.

The EU Directive 2018/822 also covers situations where some people might dodge the obligation to report, pretending they did not know that they should report. Thus, the EU Directive expressly refers to persons who “know or could be reasonably expected to know that they have undertaken to provide, directly or by means of other persons, aid, assistance or advice with respect to designing, marketing, organizing, making available for implementation or managing the implementation of a reportable cross-border arrangement .”

Although this is not expressly mentioned in the EU Directive 2018/822, it is important to note that this obligation does not apply to tax consultants, lawyers, accountants, auditors or any other person who does not participate directly or by means of other persons in designing, marketing, organizing, management or implementation of a reportable cross-border arrangement (for example, it is not addressed to tax consultants who audit income tax, VAT, excise tax, or to transfer pricing consultants who are documenting only the transactions that have already taken place).

When: (i) the reporting obligation would not be enforceable upon an intermediary due to a legal professional privilege, (ii) the reporting persons are in a third country without any taxable presence in the EU, or (iii) there is no intermediary because, for instance, the taxpayer designs and implements a scheme in-house, the obligation to report cross-border arrangements rests with the taxpayer.

When do reporting obligations commence?

EU Member States are required to transpose the EU Directive 2018/822 into national legislation by December 31, 2019 and apply the new rules from July 1, 2020.

Once the rules become fully applicable, intermediaries and taxpayers will be required to file information with their national tax authority within 30 days of the first of the following dates:

(i) on the day after the reportable cross-border arrangement is made available for implementation; or

(ii) on the day after the reportable cross-border arrangement is ready for implementation; or

(iii) when the first step in the implementation of the reportable cross-border arrangement has been made; or

(iv) (only when an intermediary is involved) when the intermediary provided aid, assistance or advice.

What information must be disclosed?

Although the EU Directive 2018/822 does not specify what kind of information will need to be reported, it specifies a minimum of information regarding these cross-border arrangements that tax authorities will have to automatically exchange.

The DAC6 Directive requires that the following information is automatically exchanged by Member States:

(a) identification of intermediaries and relevant taxpayers (including name, date and place of birth, tax residence, tax identification number and associated enterprises);

(b) details of the relevant hallmarks that make the cross-border arrangement reportable;

(c) a summary of the content of the reportable cross-border arrangement;

(d) the date of first step of implementation;

(e) details of the national provisions forming the basis of the reportable cross-border arrangement;

(f) the value of the reportable cross-border arrangement;

(g) Member States which are likely to be concerned by the reportable cross-border arrangement; and/or

(h) identification of any other person in a Member State likely to be affected by the reportable cross-border arrangement.Ce trebuie să facă un contribuabil din România ca urmare a adoptării Directivei 2018/822/UE?

What does the EU Directive 2018/822 DAC6 mean for tax consultants?

An intermediary (including tax consultants) who has contributed to the development of reportable cross border arrangements since June 25, 2018 should keep adequate records of these arrangements in case they are required to make a report in August 2020.

Tax consultants which have the obligation to report may find it difficult to manage the relationships with their clients, as reporting on the cross-border arrangement might be troublesome for their clients and, more than that, may lead to a loss of confidence from their clients.

Nevertheless, an intermediary should check whether that he is not entitled to legal professional privilege.

Those intermediaries which are entitled to legal professional privilege or those which, for any reasons, may not be subject to the reporting obligation, should inform their clients about this situation and the fact that they themselves must comply to this obligation.

However, it should be taken into account that most tax consultants are not involved directly nor indirectly in designing, marketing, organizing, making available for the implementation or managing the implementation of a reportable cross-border arrangement.

What does the EU Directive 2018/822 DAC6 mean for taxpayers?

If the taxpayer designs and implements an optimization scheme in-house, the obligation to report cross-border arrangements rests with the taxpayer.

If the reporting obligation of a cross-border arrangement falls on the taxpayer, he should consider if the cross-border arrangement carried out meets the hallmarks set out in the EU Directive 2018/822 and if so, he has the obligation to submit a report to tax authorities regarding that cross-border arrangement even though it was designed, organized and implemented before July 1, 2020.

It is interesting to note that the taxpayer may choose not to submit the report, in which case they have to assume the penalties substantiated by his home Member State.

If the taxpayer relies on disclosure by an intermediary, he must ensure that the intermediary disclosed the information at the appropriate time.

When considering the administrative burden for taxpayers, it can be only concluded that the EU Directive 2018/822 makes the taxpayer situation more complex.

Penalties

The Directive leaves it up to each Member State to decide what penalties are to be imposed at a national level for not meeting the reporting requirements. The only requirement being that the penalties should be set at a level that encourages compliance and maximizes their deterrent effect.

A list of Member States that transposed the EU Directive 2018/822 in their national legislation or created a draft bill implementing the provision of the Directive and a short view of the penalties that are imposed, is presented below:

Netherlands

Failure to comply with the Mandatory Disclosure Rules reporting obligations will incur a penalty amounting to a maximum of 830,000 EUR.

Italy

The penalties for failure to comply with the reporting obligation may vary depending on the cause of the failure and it can range from 2,000 EUR to 21,000 EUR.

Germany

Non-compliance with the obligation to report constitutes an administrative offense and is subject to a fine of up to 25,000 EUR per breach.

Germany will not impose penalties for failure to report the arrangements developed before 1 July 2020.

Austria

Although no official documents are available yet, it is likely that the level of penalties for failure to comply with the Mandatory Disclosure Rules reporting obligations, like the penalty for failure to file Country-by-Country reports is currently up to 50,000 EUR.

Poland

Regarding sanctions imposed by Polish law, failure to comply with the Mandatory Disclosure Rules reporting obligation will be penalized with a fine of up to 4.7 million EUR.

Slovenia

The penalties for failure to comply with the reporting obligation may vary depending on the cause of the failure and it can range from 30,000 EUR to 150,000 EUR if non-reporting qualifies as a serious tax offense.

Sweden

The proposed penalties for non-compliance can be levied up to the equivalent of 50,000 EUR.

In conclusion

Now that the EU Directive 2018/822 has become effective across some EU Member States, intermediaries and taxpayers should be aware of their obligations.

In order to prevent the potential risks arising from the from the provisions of the EU Directive 2018/822 regarding reporting obligations, both the intermediary and the taxpayer should initiate internal adequate process in order to assess the scope of those obligations.

All information on cross-border arrangements to be communicated to tax authorities in a Member State will be automatically exchanged between all tax authorities in the European Union.