Article also available in / Articol disponibil și în limba: ![]() Română (Romanian)

Română (Romanian)

Transfer pricing news from the period January to September 2020

article published on 22 September 2020

- The criteria used by the Romanian Tax Authorities within risk rating process. We published an article presenting some of the criteria we have seen applied by the Romanian Tax Authorities in the selection of those taxpayers to be subjected to tax audits. Article also published on hotnews.ro.

- The High Court of Romania decided that the statute of limitation period is of 5 years and not 6 as ANAF had previously claimed. The Romanian Tax Authorities are already taking this decision into account as the new tax audits initiated in 2020 are assessing the period until 2015 at the latest.

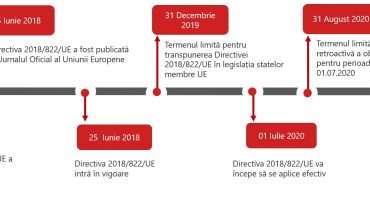

- Certain deadlines for reporting cross-border arrangements (DAC6) have been postponed. The new deadlines, i.e. January 31, 2021 and February 28, 2021 are rapidly approaching. Please be reminded that the fines for failing to declare and submit can reach up to 100,000 RON.

- The Romanian Tax Authorities performance report for 2019 has been published. Significant efforts are made to train the tax audit teams in the field of transfer pricing. In practice, the curiosity of tax auditors toward transfer pricing issues has increased compared to the previous years.

- Romanian Tax Authorities started a major reorganization in February 2020, finalizing this process in July 2020. The most important change refers to the set-up of the specialized risk assessment department, which includes statistics specialists, and we can already see in practice more and more well-targeted tax audits.

- OECD published its first conclusions after analysing the CbCR reports. The Romanian Tax Authorities now have a new tool to identify and thus investigate multinational companies that report losses in Romania and profits in other jurisdictions.

- Important clarifications on the tax consultants’ obligation to submit the DAC6 reports. Tax consultants will not be required to disclose the report if the written consent of the taxpayer they represent has not been obtained.

- Romanian Tax Authorities plans for this year and for 2021. The tax authorities’ plan includes increasing the number of tax audits performed at the level of e-commerce companies, as well as increasing the number of fast VAT refund procedures.

- The structure of statement 394 regarding VAT has been changed. Romanian Tax Authorities are using the new format of the statement 394 to identify those taxpayers conducting transactions with affiliated parties and ultimately include this information within the risk rating analysis process.

- We have completed the implementation process of uiPath robots. Using automation in the preparation of the transfer pricing documentation helps us increase efficiency both in terms of timing and costs.