Article also available in / Articol disponibil și în limba: ![]() Română (Romanian)

Română (Romanian)

OECD published the framework that will be the ground-stone for the automatic exchange of Mandatory Disclosure Rules reports

article published in 14 july 2019

Context

On 15 July 2014, the OECD published the Standard for Automatic Exchange of Financial Information in the Tax Field, known as the “Common Reporting Standard” or “CRS”, and which in fact represents a general framework for the exchange of certain information in the field of taxation between authorities tax jurisdictions in multiple jurisdictions.

In fact, this CRS standard will oblige the tax authorities in more than 100 jurisdictions (i) to obtain certain information from financial institutions located in their jurisdiction regarding certain financial information of non-residents and (ii) to exchange information thus obtained with tax authorities in the jurisdiction of the non-resident’s residence.

The CRS standard has clearly limited the financial information that can be exchanged between the tax authorities, the types of financial institutions that have the obligation to provide information, the types of entities whose information can be exchanged, and the due diligence process that they should implement the financial institutions before entering into a contractual relationship.

All these limitations of the CRS standard have allowed certain taxpayers to create and implement various opaque offshore arrangements and structures to avoid the provisions of the CRS standard and ultimately to help them obtain tax benefits.

Thus, starting from the general framework set by the CRS standard and Action 12 of the BEPS action plan, the OECD published in 2018 a manual entitled “Model Mandatory Disclosure Rules for CRS Avoidance Arrangements and Opaque Offshore Structures”.

This manual establishes the framework for taxpayers and consultants to assess and report to tax authorities (i) arrangements to avoid CRS standards and (ii) opaque offshore structures that may erode the taxable base of a particular jurisdiction, even from the moment when these arrangements and structures are created.

Thus, through these “Mandatory Disclosure Rules” (MDR), it is intended to identify all those entities that obtain tax benefits that previously could not be identified solely on the basis of information exchanged through the CRS standard (because those entities created a structure of arrangements and / or opaque offshore companies specifically to avoid the CRS standard).

In order to facilitate operationally and technically the exchange of reporting arrangements avoiding the CRS standard and opaque offshore company structures submitted to the tax authorities in accordance with the Model Mandatory Disclosure Rules for CRS Avoidance Arrangements and Opaque Offshore Structures, the OECD has developed and published the the International Exchange Framework for Compulsory Arrangements on CRS Avoidance Arrangements and Opaque Offshore Structures.

Thus, the exchange of these MDR reports will be based on a multilateral agreement between the competent authorities of over 100 jurisdictions, the draft version of this convention being also integrated into the International Exchange Framework for Mandatory Disclosure Rules on CRS Avoidance Arrangements and Opaque Offshore Structures.

In fact, this Convention will allow authorities from a particular State to receive information on an opaque offshore arrangement or structure that avoids the provisions of the CRS standard, to automatically exchange this information with all the other States involved in that structure and signatories multilateral convention for the exchange of MDR reports.

Moreover, the information thus obtained will enable tax authorities to carry out risk analyzes both on taxpayers and intermediaries involved in those structures.

Finally, tax authorities will be able to use this valuable information to identify gaps in their own legislation and to correct these gaps.

How are EU companies affected?

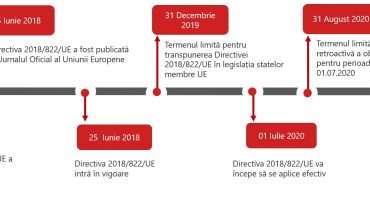

We recall that EU Directive 2018/822 / EU (also known as “DAC6”), which is largely similar to the OECD initiative, was adopted at EU level on 25 May 2018 but limited to the EU Member States and somewhat more comprehensive.

The DAC6 directive will be transposed by each Member State by 31 December 2019 by each EU Member State, and companies will have to meet their reporting obligations after July 1, 2020.

A detailed analysis of the EU DAC6 Directive can be found in our article DAC6 – New EU tax mandatory disclosure rules with regard to cross-border transactions.

Differences between DAC6 and MDR

In one of the meetings of the Working Group on Direct Taxation Cooperation (WG ACDT) there were discussed the discrepancies between OECD MDR reporting and EU DAC6 reports and the possibility to harmonize these two reports.

Although they are largely similar, a number of constraints have made this harmonization difficult, and it is highly probable that at the time of the first reporting, two sets of reports should be prepared and submitted, one using the OECD format and the other using the EU format.

This lack of harmonization between DAC6 and MDR is likely to generate confusion at taxpayers level, as well as additional administrative efforts, all the more so as more than 100 jurisdictions are expected to sign the multilateral convention on MDR reporting which most of the EU member states).

How can you prepare for OECD MDR reporting requirements?

Although there may be a temptation for some companies to consider that they are not directly concerned by this change, it should be borne in mind that the definition of an opaque offshore arrangement / structure that avoids the provisions of the CRS standard is a comprehensive one.

Therefore, a thorough consultation with the group is recommended, so that you have clear evidence of cross-border transactions and identify those that are reportable.

Consultations with the group should take into account a series of steps, including the establishment of internal processes / procedures for the assessment of all transactions, the training of staff on the characteristics that make a transaction / reporting structure and the completion of a register with all transactions / reportable structures.