The evolution and current state of country-by-country reporting (CbCR) in Romania

article published on 16 December 2024

Historical developments of CbCR requirements in Romania

For anyone working in the world of multinational businesses and taxation, the term “CbCR” might not raise an eyebrow anymore. It has become a standard term in the language of global tax compliance.

This CbCR reporting requirement targets multinational enterprises (MNEs) with consolidated turnover exceeding EUR 750 million. These companies are required to disclose to tax authorities (and more recently to the wide public) a vast array of financial information on a country-by-country basis, detailing revenue, profit, income tax paid, and other financial and non-financial information for each jurisdiction where they operate.

This article addresses both the challenges of private CbCR, which requires multinational enterprises to report data only to tax administrations since 2017, and public CbCR, a new reporting that is implemented from 2023 and which refers to the obligation of multinational enterprises to publicly disclose largely similar information that was until now reported in the private CbCR for each jurisdiction in which they operate.

Private CbCR: the confusion between CbCR notification and CbCR report

The introduction of private CbCR in Romania hasn’t been entirely smooth sailing. A persistent issue for many businesses has been the confusion between the CbCR notification (statement R405) and the CbCR report (statement R404).

Their distinct roles have led to misunderstandings for companies trying to meet their obligations.

Therefore, let’s break down the differences between the two separate statements:

- the private CbCR notification is essentially the administrative task of informing the tax authorities which entity within the multinational group is responsible for submitting the CbCR report;

- the private CbCR report, on the other hand, is the hefty document containing detailed financial information for each jurisdiction.

Now imagine someone being in charge of tax compliance for a multinational group, juggling regulations from multiple countries while trying to stay on top of your business’s core operations.

One might not be surprised to hear that many companies have fallen into the trap of either missing the notification deadline or simply not submitting the CbCR reports.

Private CbCR: Romania’s unilateral signing of the Multilateral Competent Authority Agreement (MCAA)

In a bold move that caught the attention of many in the tax world, Romania was one of the few countries that signed signed unilaterally the Multilateral Competent Authority Agreement (MCAA) for the exchange of CbCR reports, while most of the other 90+ countries signed it bilaterally.

This agreement allows tax authorities in participating countries to automatically exchange CbCR reports, promoting greater cooperation in tackling tax avoidance. It’s an important step in Romania’s ambition to be at the forefront of international tax transparency, and it has made the country a significant player in the global tax stage.

For multinational groups headquartered outside the European Union, though, this signing came with an additional set of challenges.

These groups headquartered outside the European Union had and have to submit their CbCR reports (statement R404) both in their home country and also in Romania.

Private CbCR: non-compliance penalties

In Romania, non-compliance with private CbCR requirements can result in significant penalties for multinational enterprises, namely:

- RON 70,000 lei to RON 100,000 – for failure to submit the CbC report; and;

- RON 30,000 lei RON 50,000 – for late submission of a CbC report, or providing incomplete/incorrect data in a CbC report.

If you’ve been paying attention to Romania’s tax environment, you’ll know that ANAF—the Romanian National Agency for Fiscal Administration – has started sending out non-compliance notifications regarding private CbCR.

From our experience, some companies, fully expecting that they would receive these notifications, never did. Others, surprised to hear from ANAF, were flagged for non-compliance despite having submitted their reports correctly.

The inconsistencies in the system have left many scratching their heads. But it serves as a crucial reminder: CbCR compliance is not something you can leave to chance. Even if your company hasn’t received a warning from ANAF, you might still be at risk as we expect significant enforcement of the compliance rules in 2025. The safest bet is to assume that your CbCR obligations are always active and in need of attention.

Public CbCR: Romania’s race to be a leader in public CbCR transparency

If there’s one thing that sets Romania apart from its European counterparts, it’s also the country’s ambition to be a leader in public CbCR (this time, even though largely the same information is contained within, the public CbCR reporting is seen as an accounting specific reporting rather than a tax reporting).

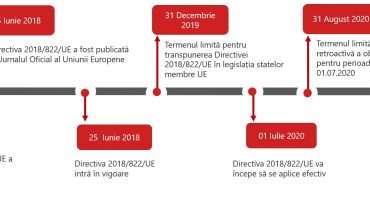

As the European Union moved toward making CbCR reports publicly available by publishing the EU Directive 2021/2101 to that end, Romania was eager to get there first.

Certain Romanian companies (i.e. local headquarters and subsidiaries of groups whose headquarters are located outside the borders of European Union) are being asked to implement public CbCR at record speed, for the financial year starting with January 1st 2023 that have a deadline of December 31st 2024 for those groups that have financial year coinciding with the calendar year. (i.e. Ministry of Finance Order 1730/07.06.2023).

This means that for the current year, some local Romanian companies (i.e. local headquarters and subsidiaries of groups whose headquarters are located outside the borders of European Union) will have to create and manage a complex reporting system, only for a one-year transition period, until the countries where their headquarters are located will also implement the Public CbCR in their legislations and then will take over the efforts of making the CbCR reports publicly available at the level of the headquarter.

This double effort is likely to generate costs but also additional non-compliance and reputational risks, with no expected benefit.

Public CbCR: challenges and the lack of procedural guidance

While the overall intent can be seen as a positive step for transparency, it has left many businesses scrambling. Rapid compliance is one thing, but doing so without clear procedural guidelines from the EU or local legislation is a whole different story.

While companies know that public disclosure deadline is coming, the specifics of how to comply are still unclear.

The most recent communication from the Ministry of Finance on public CbCR confirms that there will be no postponement of the deadline to publish the public CbCR in Romania and that there is no possibility to file the CbCR report with the Romanian Trade Registry.

Even though the Romanian Trade Registry has not implemented in due time the technical means to allow the publishing of the CbCR report , the Romanian Ministry of Finance has issued an official communication on its website.

As per the communication published by the Romanian Ministry of Finance, until the provisions of Implementing Regulation 2024/2952 will become applicable, i.e. for the financial year beginning on or after January 1, 2025, companies that have the obligation to make the CbCR report publicly available may choose one of the following reporting formats, namely:

- the reporting instructions referred to in Section III Parts B and C of Annex III to Council Directive 2011/16/EU of February 15, 2011 (i.e. the Directive regulating the standard format of the private CbCR report);

- the template and formats set out in the Implementing Regulation 2024/2952 for public CbCR, or

- by using their own reporting format, as long as the report in question contains the information required by the applicable accounting rules i.e. the Implementing Regulation 2024/2952 for public CbCR.

For businesses, uncertainty is rarely a good thing.

Public CbCR: a technical take on the actual publication

In respect to the technicalities of the public CbCR reporting, our current recommendation would be that companies subject to these compliance requirements should publish the CbCR report on their website(s) under one of the following digital formats (in Romanian language):

- same PDF file that was submitted to the Romanian Tax Authorities for private CbCR with xml attached (i.e. statement R404) ;

- PDF file with attached XHTML / XBRL;

- own simple / standard PDF with own format containing the information required by the applicable accounting rules.

Please note that the format as per Implementing Regulation 2024/2952 may be slightly limited in data as compared to what is usually reported in private CbCR statement R404 i.e.:

- dismissing information with regard to the type of the constituent entity;

- dismissing overview of the other activities as there will be no need to further provide such details;

- allowing that results for non-EU entities are presented on a aggregated basis, in a single row;

- allowing for partial disclosure of the financial indicators if strong commercial reasons could defend non-disclosure.

Furthermore, please do note that there is no specific penalty in the Romanian legislation for not publishing the Public CbCR. Only an indirect penalty may be applicable, of RON 5,000 (approximately EUR 1,000) for the delay in filing a regular statement.

Final remarks

As regards private CbCR, the legislation has been stable over the past years. However the penalties are still significant and the interest of the Romanian Tax Authorities over these reportings has more recently increased up to the point where non-compliance letters were sent to taxpayers that neglected the reporting obligations. Under these circumstances, it is highly advisable for every multinational to make sure it is fully compliant so as to avoid surprises in coming years.

As regards the public CbCR, there is an extreme complexity added to the subject by the very late issuance (in December 2024) of practical guidance by Romanian Authorities onto how to prepare and submit public CbCR. However, one has to also appreciate the fact that Romanian Authorities left to the taxpayers a wide range of options of file formats to make publicly available on their websites and that they have not imposed significant penalties for non-compliance (i.e. up to EUR 1,000).

In any way, Romania’s ambitious journey with CbCR is far from over. While the country’s efforts to be a leader in tax transparency are commendable, the fast-paced and often unclear regulatory environment is creating new challenges for businesses.

ATIPIC Solutions is a 100% transfer pricing dedicated and specialized transfer pricing firm with a culture centered around effectiveness of building reliable transfer pricing documentations though automations and innovation. We work with companies that have as their ERP of choice SAP, Oracle, Microsoft or Scala and we are recognized in the World TP / International Tax Review Rankings.

If you found this article useful, you may likely find all our other articles that we can send straight to your inbox… so we offer you the possibility to request a free of charge complimentary subscription to our newsletter if you submit the form below: